Under current regulations, basically Law 2277 of 2022, the Net Equity Tax applies in Colombia to individuals, unsettled successions of Colombian residents and to foreign entities holding assets in Colombia, which are valued on January 1st. of the taxable year for 72.000 Tax Value Units (Unidades de Valor Tributario, UVTs) or more. (72.000 UVT¹ are equal to $3.388.680.000 / USD800.506 approx., for 2024).

The Tax Bill that was recently filed by the National Government before Congress “…whereby dispositions to Finance the Nation´s General Budget and other regulations, are issued” proposes various changes regarding the application of the Net Equity Tax:

1.Taxable Event

As explained above, currently, the taxable event under Net Equity Tax rules is the possession or ownership on January 1st of 2024, of net assets equaling or exceeding $3.388.680.000 / USD800.506 approx ².

The Tax Bill proposes that the taxable event is extended to the possession of net assets equaling or exceeding 40.000 UVTs ($1.882.600.000/ USD 445.000 ³ for 2024), on January 1st and subsequent years.

It extends the taxable event and the taxable persons, to the possession of unproductive real estate for the same value, by legal entities incorporated in Colombia.

2.Taxable basis and Progressive Rates.

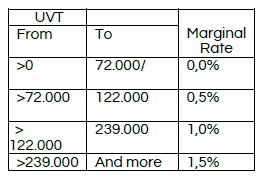

Currently the Net Equity Tax applies at the following marginal rates:

¹ UVT 2024: $47.065

² Exchange Rate in force to Date: USD1= COP4233,17.

³ 72.000 UVT 2024: $3.388.680.000

µ 40.000 UVT 2024: $1.882.600.000

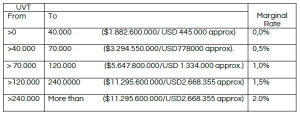

The Tax Bill proposes the following rates:

a. For individuals and unsettled successions of Colombian residents and foreign companies holding assets in Colombia, with the exclusion of Portfolio Investment or Financial Lease Agreements:

b. For legal entities incorporated in Colombia, a unified rate of 1.5% on the value of unproductive real fixed assets equaling or exceeding 40.000 UVT/$1.882.600.000/approximately USD 445.000µ.

In compliance with dispositions regarding the administration of personal data, REYES ABOGADOS ASOCIADOS S.A requests that you contact us if you are not interested in receiving legal updates. This bulletin is a Service by REYES ABOGADOS ASOCIADOS S.A., which is sent exclusively for information purposes with no intention to render legal advice. For specific cases, we recommend that individual assistance is sought before making decisions based on the information contained herein.